td ameritrade tax withholding

It just matters what the total balance of the rollover is as that is what will be counted as income this tax year. If you put 1 into a traditional IRA then it grows to 1M then you perform a.

How To Read Your Brokerage 1099 Tax Form Youtube

This section is very useful for information about reportable transactions tax documents availability tax reporting questions and RMD calculations just to name a few.

. Dividends and Interest Income. Ad No Hidden Fees or Minimum Trade Requirements. Open an Account Now.

Open an Account Now. If its held for more than a year its considered a long-term gain and the tax rate could reach 20. TD Ameritrade does not provide tax advice.

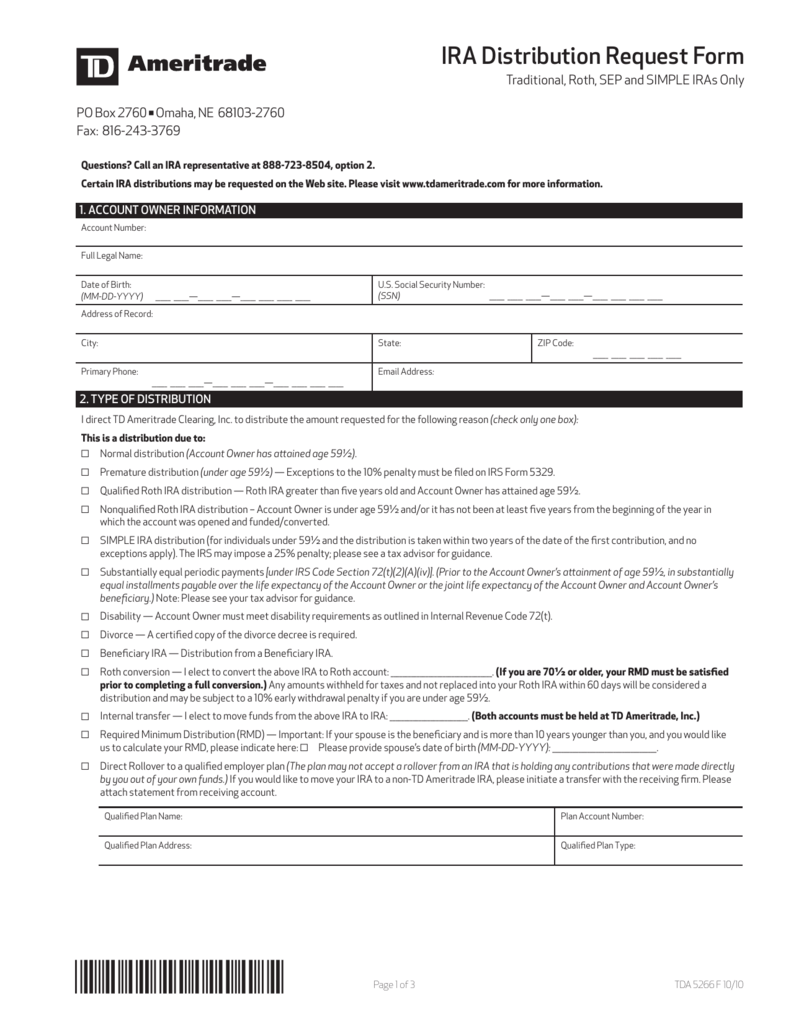

Taxes related to TD. Internal Revenue Service IRS on your behalf so no additional tax is due after. ACCOUNT OWNER INFORMATION Account Number.

If youre a US. 58 of households with an income of less than. Taxpayer with at least 10 in dividend income youll receive a 1099-DIV form from TD Ameritrade along with a consolidated 1099 form.

We suggest you consult with a tax-planning professional with regard to your personal circumstances. And taxpayers often use their refund money to pay off debt or put into savings. Mailing date for Form 1042-S and Real Estate Mortgage Investment ConduitWidely Held Fixed Investment.

TD Ameritrade Clearing Inc. The tax rate varies based on how long the security was held before it was sold. Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the 746th-largest US.

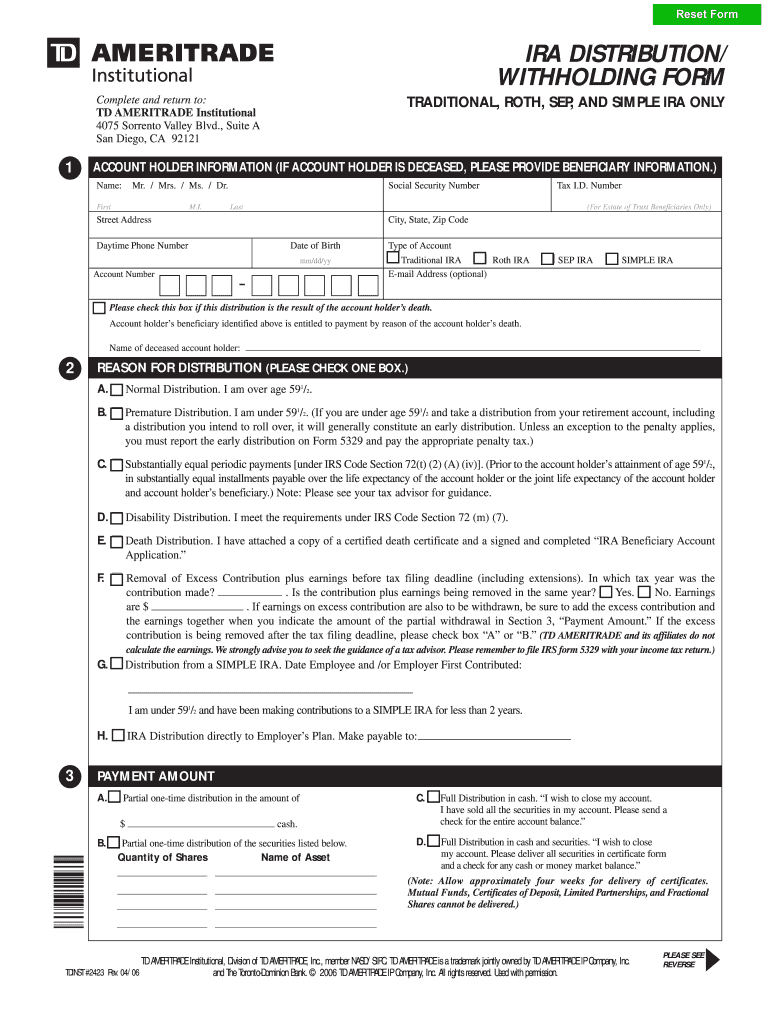

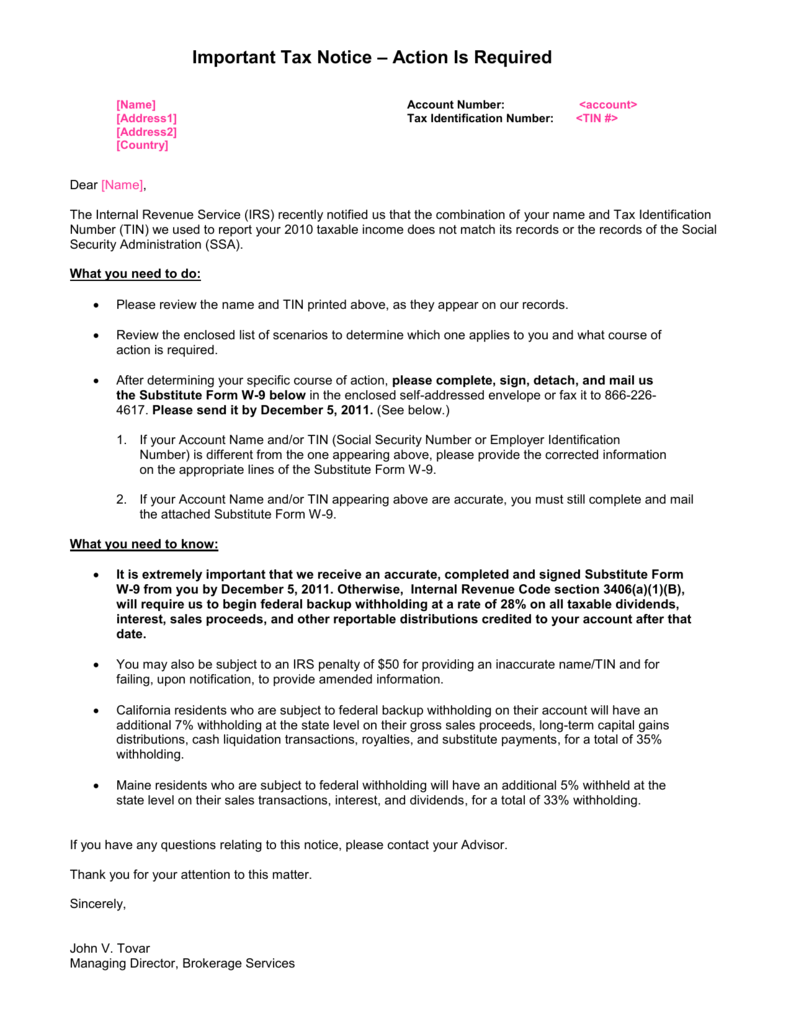

If you make no election Michigan requires that withholding be taken at the minimum rate of 425 on distributions from retirement. Maine residents who are subject to federal withholding will have an additional 5 withheld at the state level on their sales transactions interest and dividends for a total of 33 withholding. Withholding Amount Federal income tax withheld 28463 Changes to dividend tax classifications processed after your original tax form is issued for 2021 may require an amended tax form.

Michigan requires state income tax for all distributions. Is required by federal andor state statutes to withhold a percentage of your IRA distribution for income tax purposes. Ad No Hidden Fees or Minimum Trade Requirements.

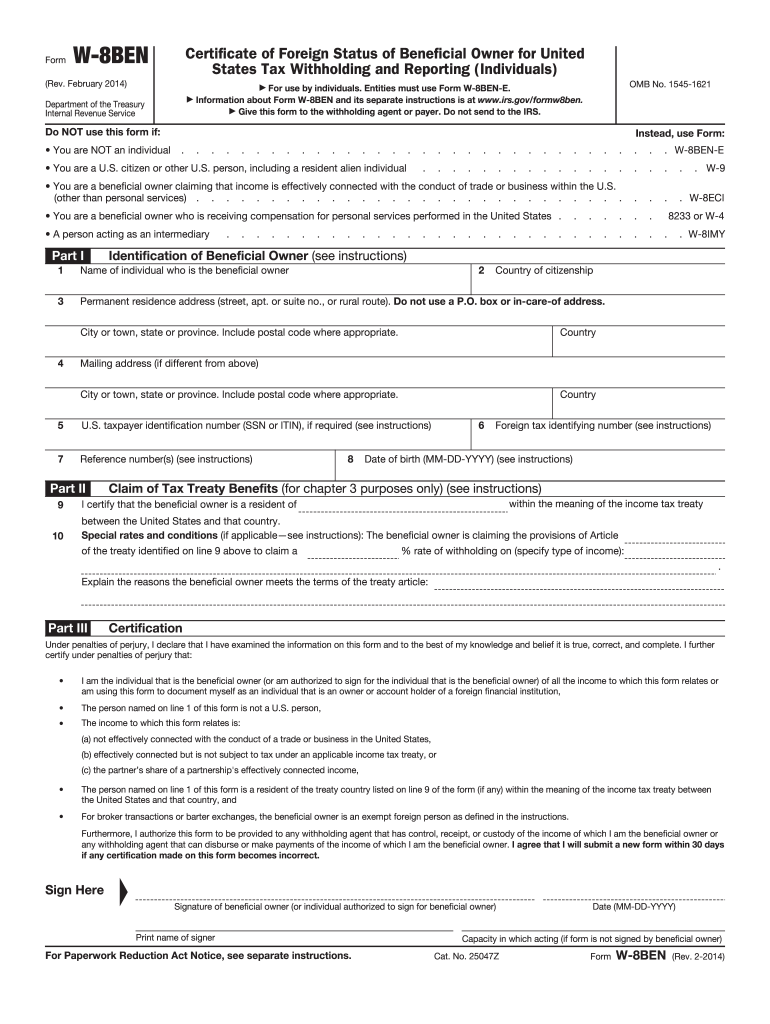

-- Any Shareholder who claims to be entitled to a Reduced Tax Withholding Rate in accordance with the foregoing will be required to provide the Agent with all relevant. Mailing date for Forms 4806A and 4806B. TD Ameritrade Clearing Inc.

You may not have a year-end tax bill because the withholding is remitted to the IRS on your behalf when the income is deposited into your account. According to a March 2019 TurboTax survey. State Withholding If you change the state of residence listed on your account you will be responsible for any state withholding tax implications.

The statutory tax rate is 30. This is Non-Resident Alien NRA withholding that is withheld by TD Ameritrade Singapore and sent to the US. In some cases you may elect not.

TD Ameritrade Singapore will withhold on applicable distribution income at the time of payment as discussed in the disclosure document provided above. Use this form to update your tax withholding elections for verbal distributions or periodic payments IRAs only.

Fill Free Fillable Td Ameritrade Pdf Forms

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Td Ameritrade W8ben Fill Online Printable Fillable Blank Pdffiller

Ameritrade Ira Distribution Withholding Form Fill Online Printable Fillable Blank Pdffiller

How To Register A Td Ameritrade Account In Malaysia Marcus Keong

Td Ameritrade Says I Made 196k In 3 Months R Tax

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

Td Ameritrade Says I Made 196k In 3 Months R Tax

Logo Td Ameritrade Institutional

Fill Free Fillable Td Ameritrade Pdf Forms

Td Ameritrade Says I Made 196k In 3 Months R Tax

Td Ameritrade W 8 Ben Part 2 R Phinvest

What Is The W 8ben Form Certificate Of Foreign Status Youtube

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Do Non Us Citizens Need Itin To Trade Stocks On Td Ameritrade And Enjoy Earning From That Quora